How Convex Enhanced Operations with

Automated Insurance Underwriting and Intelligent Integration

Client Overview

Convex is an international specialist insurer and reinsurer founded by industry leaders Stephen Catlin and Paul Brand. With operations in Bermuda, London, and Europe, Convex stands out in the insurance industry by leveraging deep expertise, a strong reputation, and a legacy-free balance sheet to provide innovative risk solutions.

Business Objective of Convex

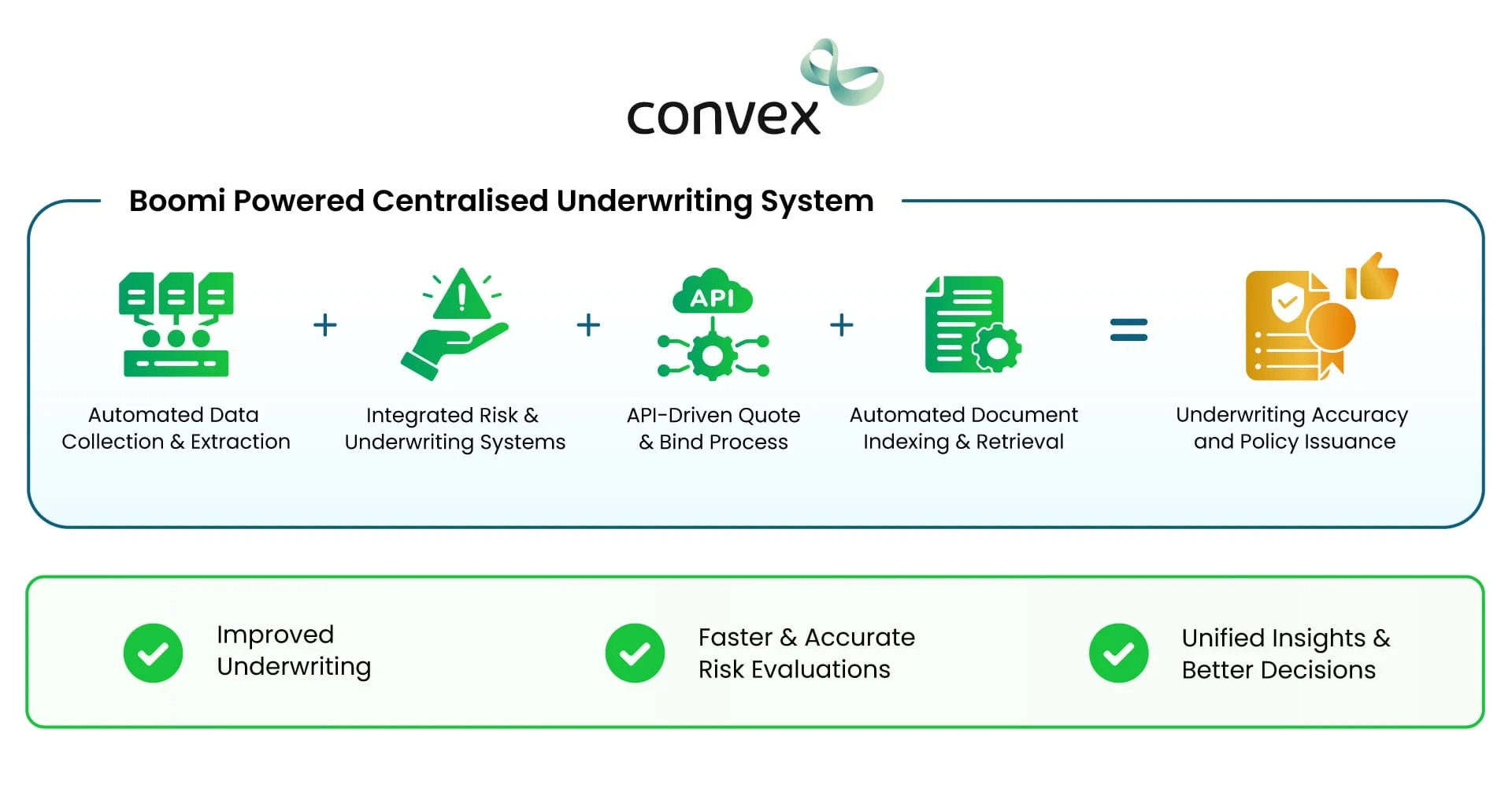

Convex’s primary objective was to improve operational efficiency, reduce manual intervention and improve data accuracy by seamlessly integrating multiple platforms. They aimed to bring automation to insurance operations by streamlining the underwriting process, risk assessment, and financial management. Also, the insurance company wanted to accelerate product development by enhancing the collaboration between modelling tools and risk assessment. Overall, they sought a solution to create a scalable and agile system to support increasing data volumes, complex integrations and digital expansion, ultimately reducing costs.

Industry

Insurance

Platform

Boomi

Service

Integration, Automation

Challenges

Fragmented Data Sources

Insurance data scattered across portals, internal platforms, and third-party applications made data collection and validation difficult.

Manual-Dependent Processes

Underwriting, risk assessment, and financial management relied heavily on manual effort, causing delays and errors.

Complex Compliance Management

Time-consuming, error-prone handling of large insurance documents complicated regulatory compliance.

Lack of System Integration

Key systems like underwriting tools, pricing, catastrophe modelling, and document indexing were disconnected, hindering decision-making.

Want to eliminate manual bottlenecks in underwriting? As a Boomi Partner, we help you automate submissions, risk assessment, and compliance with intelligent integration.

Contact Our Boomi ExpertsSolutions

Complex Submission and Screening Processes

We integrated an automated data collection and extraction framework that connected multiple placing portals and internal systems. This automated insurance underwriting system improved preliminary screening, minimized manual effort, and enabled seamless data transmission for underwriters.

Inefficient Risk Assessment and Evaluation

We introduced a centralized underwriting tool suite to connect risk assessment models, pricing systems, and catastrophe modeling tools. This approach further enhanced the information flow, reduced manual efforts, and enabled quick and accurate risk evaluation.

Disconnected Systems Limiting Underwriter Insights

We developed a solution to integrate risk assessment tools with key underwriting systems to create a connected ecosystem. With consolidated insights from all the platforms, underwriters can analyse policies, claims and compliance data in one place.

Manual Quote and Binding Processes

To ensure seamless communication between brokers and underwriters, we enabled API-driven digitization of the quote and bind process. This digitization reduced turnaround times and enhanced broker and underwriter engagement.

Scattered Document Management

We integrated a document indexing service with Dropbox for seamless, structured data extraction and retrieval. This significantly reduced the time and effort to store, locate, and access underwriting documents from multiple locations.

Financial Management Challenges

We integrated financial management systems to ensure seamless reporting and compliance. Also, we implemented a single strategic management platform which allows professionals to focus on underwriting support and client service instead of working on low-value tasks.

Results

Faster Submission Processing

Automated data extraction and screening reduced delays and improved efficiency.

Improved Risk Assessment Accuracy

Integration of systems enhanced accuracy and reliability in risk evaluation.

Accelerated Quote & Bind Workflows

API-driven automation shortened turnaround times for quotes and binding.

Streamlined Compliance & Reporting

Automated financial integrations and better document management improved compliance and reporting.

Technology Stack

Related Case Studies

Get in touch

Tell us what you're looking for and we'll get you connected to the right people.