UK Law Firm Connected Intapp

Intake and SAP S/4HANA to Streamline Client Onboarding

Client Overview

Our client is a UK-based law firm established in the 20th century. Today, they have a strong presence both nationally and internationally. The firm is known for its legal expertise and people-focused approach. With over 600 professionals and 70 partners, they offer a comprehensive range of legal services to clients across various sectors. The organization’s focus on people, culture, and innovation has positioned it as one of the most progressive firms in the legal industry.

Business Objective

The law firm leverages Intapp Intake to manage new client and matter onboarding, including risk and compliance approvals, while SAP S/4HANA functions as the enterprise financial and reporting system. The firm aimed to eliminate manual handovers between intake and finance, ensure that no client is financially activated without compliance clearance, and establish a governed, auditable onboarding process. The objective was to accelerate time-to-billing, reduce compliance risk, and maintain a single, trusted client record across systems.

Intapp Intake: Enabling Controlled, Compliant, and Efficient Client Onboarding

Intapp Intake is a purpose-built new business onboarding solution designed specifically for professional services firms, particularly law firms. It centralizes client and matter intake, conflict checks, AML/KYC validation, and internal approvals into a single governed workflow before a client is financially activated. By embedding risk and compliance controls directly into the onboarding process, Intapp Intake ensures that no engagement proceeds without proper clearance.

Industry

Professional Services

Platform

Intapp

Service

Intapp Intake Integration

Challenges

Disconnected Intake and Finance Workflows

Client information approved in Intapp Intake was not automatically available in SAP, creating operational silos between intake, compliance, and finance teams.

Compliance Risk

Clients could be created in SAP before conflict checks, AML/KYC validations, or internal approvals were fully completed.

Manual Data Entry

Finance teams were required to re-enter client data into SAP, increasing the risk of errors, duplication, and inconsistent records.

Lack of Canonical Client Data

Different data structures across systems made it difficult to maintain a single source of truth for client information.

Limited Audit Trail

Tracking approval status, compliance decisions, and financial activation across systems was time-consuming and lacked transparency.

Delayed Time to Billing

Gaps between intake approval and SAP client creation slowed billing readiness and impacted revenue realization.

Explore our full range of Intapp integration services designed to streamline client onboarding and operational workflows.

Explore our Intapp Integration ServicesSolutions

Compliance-First Architecture with Intapp Intake

As Intapp Partner, we designed an intake-driven architecture where Intapp Intake acts as the controlling system for all new client onboarding. Compliance-approved client records, including legal name, jurisdiction, responsible partner, and approval status, were allowed to flow downstream, ensuring only validated clients progressed to finance. This eliminated the risk of premature financial activation and enforced compliance by design.

Compliance API to Enforce Governance

To address fragmented approval processes, our Intapp experts implemented a Compliance API that consolidated conflict check outcomes, AML/KYC indicators, approval timestamps, and approver roles. These compliance attributes traveled alongside client master data, ensuring governance decisions were embedded into the integration flow and consistently enforced before any financial record creation.

Common Data Store API for Data Consistency

To resolve inconsistent client data across systems, we introduced a Common Data Store API with a canonical client data model. Client master attributes, such as legal entity, address, jurisdiction, and ownership details, were standardized and normalized before distribution, establishing a single source of truth and ensuring data consistency across all downstream integrations.

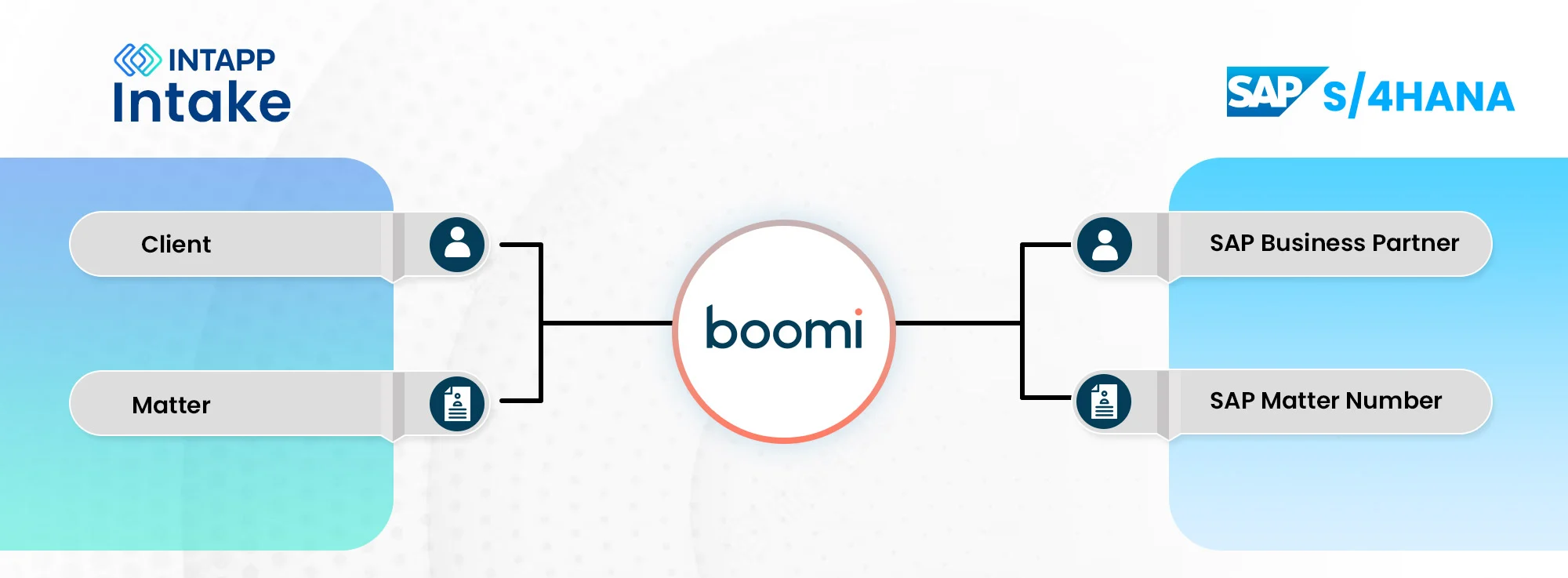

Automated Client Creation in SAP S/4HANA

Once compliance approval is confirmed, automated client creation in SAP S/4HANA is initiated via Boomi. Approved client master data was used to create finance-ready Business Partner records. In contrast, SAP-generated system-owned attributes, such as client IDs, account numbers, and activation status, were used to remove manual data entry and reduce errors.

Bi-Directional Status Synchronization

To improve transparency and auditability, we enabled bi-directional data synchronization. SAP-generated client identifiers, financial activation status, and creation confirmations were sent back to Intapp Intake, providing intake and compliance teams with real-time visibility into financial readiness and closing the loop between intake and finance.

Results

Accelerated Client Onboarding

The firm significantly reduced onboarding cycles by removing manual handoffs between intake, compliance, and finance teams.

Improved Data Accuracy

A single, governed client record eliminated duplication and inconsistencies across enterprise systems.

Stronger Audit Readiness

End-to-end traceability of approvals and system updates simplified audits and internal reviews.

Scalable Integration

The API-led architecture provides a future-ready foundation to extend integration to matter management, billing workflows, and additional legal and enterprise systems.

Technology Stack

Related Case Studies

Get in touch

Tell us what you're looking for and we'll get you connected to the right people.